does florida have state estate tax

The federal estate tax for the 2022 tax. Then depending on whether the winners state taxes lottery winnings he may have to add state taxes tooMost.

Taxes In Florida Does The State Impose An Inheritance Tax

Be sure to file the following.

. Figuring out the amount of your doc stamps. In Florida transfer taxes are also referred to as documentary stamps or doc stamps and theyre typically paid by the seller. What this means is that estates worth less than 117 million wont pay any federal estate taxes at all.

In addition to sales tax revenue Florida citizens benefit from exempting the estate from property taxes. The Federal government imposes an estate tax which begins at a whopping. Florida is 1 of only 7 states that do not tax individual wage income.

What state taxes do you pay in Florida. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the. Federal Estate Tax.

Just because Florida lacks an estate or inheritance tax doesnt mean that there arent other tax filings that an estate must complete. The states intangible personal property tax was. In Florida either the decedent or the estate needs to pay the property tax bill issued in the fall by March 31st.

Other taxes Florida residents pay include property tax sales tax and business. As executor you would have to file a Form 1041 Income Tax Return for Estates and Trusts if the estate had either gross income of 600 or more for the tax year or one or. Federal Estate Taxes.

Previously federal law allowed a credit for state death taxes on the federal estate tax return. The winner takes home 6285 million after federal tax. Even though Florida doesnt have an estate tax you might still owe the federal estate tax which kicks in at 117 million for 2021.

As mentioned Florida does not have a separate inheritance death tax. Answer 1 of 8. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

They couldnt function if they didnt It is true that they dont have a state income tax. The federal government however imposes an estate tax that applies to all United. It does however assess a state corporate income tax.

Its called the 2 out of 5 year rule. No portion of what is willed to an individual goes to the state. Located at 250 S.

Florida has several state taxes. Florida doesnt have a state income tax. Florida does not have personal income estate or.

Florida residents are fortunate in that Florida does not impose an estate tax or an inheritance tax. Florida also does not assess an estate tax or an inheritance tax. It lets you exclude capital gains up to 250000 up to 500000 if filing jointly.

Florida does not have a state income tax. Several states dont have an income tax. The state of Florida doesnt have an estate tax but that doesnt make you exempt from the Internal Revenue Services federal estate tax.

November 8 2022. Florida is one of a few states that does not have state income tax making the state a popular Floridians like most everyone around the world pay taxes. Floridas corporate income tax rate was increased back to 55 as of Jan.

This means that seasonal residents as well as those who own rental and. A federal change eliminated Floridas estate tax after December 31 2004. Heres an example of how much capital gains tax you might.

If they owned property in another state that state might have a.

:max_bytes(150000):strip_icc()/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

Does Florida Have An Estate Tax

Legal Advice To Avoid Taxes On Inheritance

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return

Estate Tax In The United States Wikipedia

Dr 312 2002 Form Fill Out Sign Online Dochub

State Estate And Inheritance Taxes In 2014 Tax Foundation

Florida Estate Tax Everything You Need To Know Smartasset

Florida Form Estate Fill Out Printable Pdf Forms Online

What Taxes Do I Have To Pay If I Receive An Inheritance In Florida St Lucie County Fl Estate Planning Attorneys

Latest News Okeechobee County Edc

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

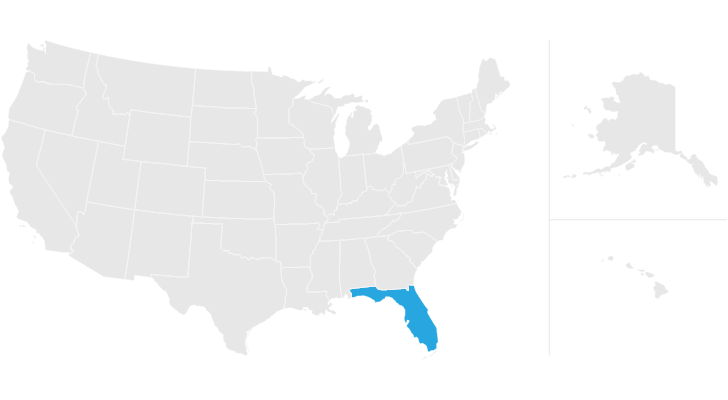

Does Your State Have An Estate Or Inheritance Tax

How Does Massachusetts Tax Estates Of Non Residents With In State Real

Florida Taxes A Look At The Difference Between Florida And Other States

How Do I Become A Florida Resident Boyer Boyer

In Florida Homeowners Come For The Weather And Stay For The Tax Relief Mansion Global

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)